Accountants looking to make the move to Ireland… what you need to know first…

So, you have noticed that accountants are eligible for that “golden ticket” called a Critical Skills Employment Permit (CSEP). Golden for many reasons but especially the fact that you can immediately bring over your spouse and kids.

When looking to work in Ireland, you will need to see if your career, training and experience is indeed eligible for a work permit in Ireland

In very brief summary:Ineligible means: that even if you have a job offer, you will not be getting a work permit, you cannot work in Ireland in that career.

Critical skills: this is a very high demand career and will offer you a work permit subject to the terms and conditions, and if successful your spouse and/or children can join immediately with you and your spouse subject to conditions can get a work permission too

General: means you can get a work permit subject to many terms and conditions, your spouse and/or children can join you 12 months later subject to more conditions, but they cannot work without their own work permit

As a Qualified Accountant, when starting this process, it is very important to know what your SOC code is… let’s look at that first.

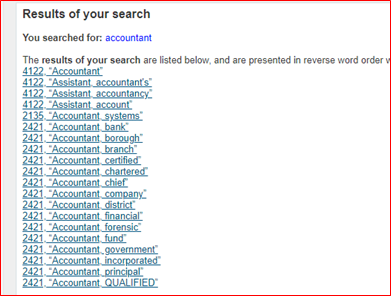

When searching for “accountant” (ONS Occupation Coding Tool (onsdigital.github.io)) you get these results:

As you can see two very obvious codes pop up. 4122 and 2421.

You have to be absolutely sure which description fits your work experience and most importantly your qualifications.

Unfortunately, code 4122 is NOT ELIGIBLE for a work permit at all (no not even a general work permit).

4122: BOOK-KEEPERS, PAYROLL MANAGERS AND WAGES CLERKS- ineligible for work permit

Job description:

Book-keepers, payroll managers and wages clerks maintain and balance records of financial transactions, oversee the operation of payroll functions and calculate hours worked, wages due and other relevant contributions and deductions.

Tasks required by this job include:

records and checks accuracy of daily financial transactions;

prepares provisional balances and reconciles these with appropriate accounts;

supervises payroll team and develops payroll systems and procedures;

calculates and records hours worked, wages due, deductions and voluntary contributions;

processes holiday, sick and maternity pay and travel and subsistence expenses;

compiles schedules and distributes or arranges distribution of wages and salaries;

calculates costs and overheads and prepares analyses for management.

Jobs related to this code:

Accounts administrator

Accounts assistant

Accounts clerk

Auditor

Bookkeeper

Payroll clerk

This code is on the ineligible list of careers.

As an unregistered accountant/ not yet fully qualified or registered, you would fall into bookkeeper- which is ineligible for a work permit- this would be the same for debtors and creditors clerks, payroll etc

In Accounting, only code 2421 features on the critical skill list

So, let’s take a deeper look at code 2421:

2421: CHARTERED AND CERTIFIED ACCOUNTANTS - critical skills, with a degree and registration

Qualified accountants with at least three years’ auditing experience, who are full members of the American Institute of Certified Public Accountants (AICPA), Philippine Institute of Certified Public Accountants (PICPA) and the Institute of Chartered Accountants of Pakistan (ICAP) and whom have relevant work experience in the areas of US GAAP reporting and Global Audit and Advisory Services and the employment concerned is in MNC Global Audit Services.

Tax consultant specialising in non-EEA tax consultancy and compliance with a professional tax qualification or legal qualification with tax specialist, and has a minimum of three years’ experience of tax consultancy requirements and regulations in the relevant non-EEA market.

Job description:

Jobholders in this unit group provide accounting and auditing services, advise clients on financial matters, collect, and analyse financial information and perform other accounting duties required by management for the planning and control of an establishment’s income and expenditure.

Tasks required by this job include:

plans and oversees implementation of accountancy system and policies.

prepares financial documents and reports for management, shareholders, statutory or other bodies.

audits accounts and book-keeping records.

prepares tax returns, advises on tax problems and contests disputed claim before tax official.

conducts financial investigations concerning insolvency, fraud, possible mergers, etc.

evaluates financial information for management purposes.

liaises with management and other professionals to compile budgets and other costs.

prepares periodic accounts, budgetary reviews, and financial forecasts.

conducts investigations and advises management on financial aspects of productivity, stock holding, sales, new products, etc.

They are in particular looking for:

Chartered and certified accountants, and taxation experts specialising in tax, compliance, regulation, solvency or financial management or related and relevant specialist skills, qualifications, or experience.

Jobs related to this code:

Accountant (qualified)

Auditor (qualified)

Chartered accountant

Company accountant

Cost accountant (qualified)

Financial controller (qualified)

Management accountant (qualified)

**There are other codes for related careers, if you are uncertain if your career or qualifications fit the criteria or not, it is worth getting SA2eire to do that code check for you, Click HERE

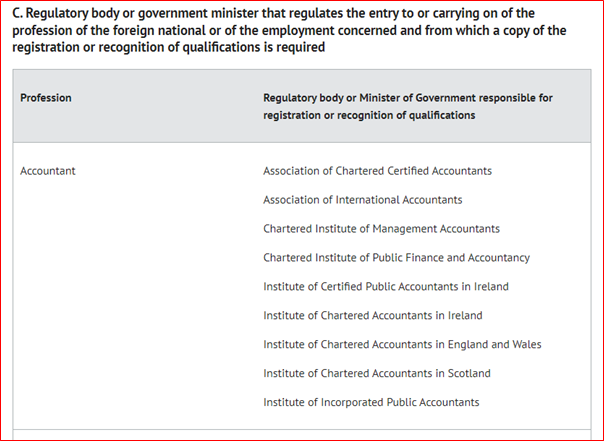

Registered fully qualified accountants with the appropriate degree are critical skills- sadly even if you got a job offer over EUR64 000 per annum- without qualifications and registration with the appropriate bodies (see below)

There are 3 very important requirements to be able to call yourself a Certified/Qualified Accountant:

- A degree

- Training (this would be what we call “articles”)

- Professional examinations (or what we would call “board exams”) in other words you belong to a professional body like SAICA, SAIPA, CIMA, etc….

Number three is especially important if you look deeper into the critical skill list. It actually has the requirement that you belong to a certain body!! As accountants we have the option to either belong to one of nine regulatory bodies or to have our designations completely accepted based on mutual recognition. You might have to do your own homework here… I will be basing this on my personal experience. I am a full SAIPA member and SAIPA enjoys FULL mutual recognition with CPA Ireland!

Registration bodies for certain employments - DETE (enterprise.gov.ie)

Before I even started to look for work, I ran through the checklist...

Yes, I have a degree (B.Com Accounting).

Yes, I did the training (SAIPA articles for 3 years, signed off and complete)

Yes, I wrote professional examinations (SAIPA board exam – passed and I am full member in good standing)

and yes, my designation enjoys full mutual recognition with one of the nine required bodies.

Phew…. Now that I am sure I am eligible the job hunting can begin.

Let me share my experience with you:

JOB HUNTING in Ireland all the way from South Africa:

Ireland is small and heavy on the community vibe. Everyone knows everyone in the industry.

The disadvantage of this is that they can often struggle with change and “outsiders”.

So, your CV and how you present yourself in your interviews is very important.

You don’t want to oversell yourself but trust me, you have to kind of convince these people to give you a chance – especially smaller firms.

Your Big 4 has zero problems with foreign appointments – if you can get a job with them (or even transfer if you already working for them) you would be sorted. They do the permits and pay for them the works!!

I didn’t do my articles with any of the Big 4 so I had to target smaller firms to get an offer.

I am a Professional Accountant (SA), and I knew it will not be as easily recognised here so I made the choice to have my designation recognised by CPA Ireland and became a full member with them. I felt it would be much easier if my CV said CPA Ireland. Talking about CV’s…

The first thing I did before ever letting my CV “float around” out here I had it professionally done in the Irish format. Lyndon Friend is a popular suggestion on the SA2Eire group, and I also used his services – which were really as great as everyone says.

One thing about the CV’s that the professionals did not agree with me on is putting something at the end of your CV on how work permits work. Personally, for me, this helped a lot. So that potential employers who have never heard of work permits could understand what it is about, that it is not much effort for them, it is quick, I will pay for it myself, etc. TIPS on getting employed and CV's on SA2eire HERE

Another hot topic when looking for work is recruiters.

I will add a list of some wonderful people I worked with but in the end, they did not get my job for me – I did.

By directly approaching firms via LinkedIn.

But at least these guys now know the ins and outs of the CSEP so going forwards they should be able to help others better.

This is the absolute basics on accountants making the big move to Ireland. Always do as much homework as possible as we all have different circumstances, book that session with Megan and Vicky – it made us feel a lot more comfortable and organised.

Goodluck with your journey – it will be hard, there will be tears, you will feel stress you have never felt before, but it is so worth it.

I have been here almost a year and we are so happy.

My child has so much freedom, the work environment is so focused on family.

It is beautiful here.

It is home!

Regards, Estée